If you own an enterprise, you’ll require to know how to obtain an EIN number to file your taxes. Before you begin the steps to obtain one EIN number, it is necessary to understand the meaning of the number and explain the reason why it is needed.

What Is an EIN Number?

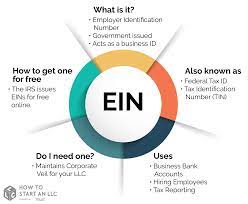

In the words of the Small Business Administration (SBA) according to the Small Business Administration (SBA), an EIN number is a distinct nine-digit tax code that can be used to identify an organization for tax purposes. The employer Identification Number (EIN) with the Social Security Number (SSN). However it is true that the EIN number is used for the filing of a tax return for business, and an SSN is used to pay personal income tax. In addition to its use in filing taxes as well, EIN numbers are also used to file taxes. EIN is required whenever the company opens a bank account or requests business licenses. Another term of one’s EIN numbers is called a tax ID issued to businesses.

How to Get a Business Tax ID or EIN Number

Before you can apply to get your EIN number, you need to answer a few questions about your company. If you’re able to respond “yes” to the following questions, you’ve met the requirements needed to be eligible for an EIN number.

- Do you employ employees? You’ll require the EIN to pay tax on the income of employees you employ.

- Are you an multiple-member, limited-liability business (LLC)? If so, you’ll require an EIN to be able to file taxes.

- Do you run your business as a company or partnership? It is not possible to conduct trade without having an EIN. (Note that if you run your business as sole proprietor and pay yourself, you do not necessarily require an EIN. However, you’ll require an EIN number to establish a bank account for your business.)

- Do you submit tax returns for tobacco, alcohol firearms, alcohol, or tobacco or do you file excise tax? If yes, then you’ll need an EIN.

- Does your business has a Keogh program? You’ll need an EIN.

- Are you a member of an employee 401(k) program? It is also necessary to obtain an EIN.

- Do you inherit a company or are you planning to purchase one? If yes you must have an EIN is mandatory.

- Do you have a business that is in bankruptcy? require an EIN to be able to prepare the paperwork and the associated taxes.

As per the Internal Revenue Service (IRS) it is required to obtain an EIN number if you are involved in business with organizations, like estates mortgage investment conduits, co-operatives of farmers, nonprofits and plan managers. Additionally, if your business is associated with specific trusts, it is necessary to find out more about how to obtain the EIN number. The exceptions, in this instance comprise grantor-owned irrevocable trusts, exempt organizations business tax returns, and IRAs.

Get an EIN Number in One of 4 Ways

EiN applicants can apply online or via fax, mail or phone. If you’re looking to get an official business I.D., you have the option of applying using any of these options. In order to apply for an EIN for the first time, you’ll need an identification code for taxpayers in the form an SSN or ITIN (for foreign residents) as well as an EIN.

The tax I.D. number you apply for is for the principal officer or owner, grantor trustor or general partner for the business. This is why the Internal Revenue Service calls these people or entities the “responsible party” – a person or organization that can be considered to be “responsible” for a business’s assets and funds as well as the distribution of funds. If the person applying for the credit is not an official entity or a governmental entity, the responsible party must be an individual.

Apply for an EIN Online

The fastest and most popular method of obtaining a business tax I.D. Number is by applying to get an EIN online. The application is completed and verified simultaneously. After everything has been confirmed and approved, you will receive your EIN for your company immediately. The online application is able to be used by anyone who’s primary company or legal home is located within the U.S. or a U.S. territory.

How to Get an EIN Number for Your Business If You Don’t Live in the U.S .

International applicants need to dial an incoming number between 6 a.m. until eleven p.m. (Eastern time) during the week of business to obtain the EIN number. Only authorized individuals can dial 267-941-1099 to get the tax-exempt business I.D. and address any questions concerning applying for an EIN. This form is an IRS Form SS-4.

The form must be completed in the Third-Party Designee portion on the form. You must also identify an authorized person to address questions about the application in order to get an EIN. Designees’ authority ceases when they receive the EIN. The signature section of the SS-4 form needs to be completed to confirm the authorisation of a designee.

Faxing Your Application

If you apply via using fax, you’ll be issued an EIN within four business days after submitting your faxed request. You must provide the fax number for the number. If you apply via mail, the total process duration is around four weeks. You must fill in form SS-4 completely. You can find the fax number or postal addresses for IRS through the IRS website.

Protect Your Identity

Although sole proprietors who have employees must have an EIN It is recommended applying for an EIN even if you’re a freelancer or sole proprietor, or even a company that is not required to obtain an EIN. The benefit of having using an EIN is that it separates your personal tax obligations from tax obligations for business. This means you are able to stay clear of any conflict along this line. Therefore, the tax I.D. decreases the likelihood for identity theft. If you have two tax I.D.s that include one with an SSN and EIN It is harder for thieves to get information on your financial holdings and earnings.

Get a Business Loan With Less Hassle

The possession of an EIN additionally enhances your professional standing and makes loan funding easier for your company. Since a majority of lenders require that business be able to open a bank account for a business which is not open without an EIN You can obtain an loan without much hassle.

With an EIN allows you to establish credit for your business and employ employees, should you need to. If you plan to operate in a U.S. business from overseas An EIN can also help you create your business with less hassle. After you have obtained an EIN it is possible to make use of it to request loan funding or to receive vendor services or establish a business bank account. Although an EIN is valid throughout the lifespan of a particular company, you’ll have to apply for an updated number if there’s a change to the ownership or structure of your business.

If, for instance, you’re sole proprietor, and decide to form a multi-member LLC , or incorporate, you’ll have to apply for an additional EIN. You might want to form a partnership with a business partner but you’ve been operating as sole owner. If this is the case you’ll need get an updated EIN in order to record the new partnership. The process of obtaining a new EIN only applies to modifications to the structure of your business or ownership. There is no need to obtain an additional EIN in the event that it changes the name you use for your company or move it to a new place of business.